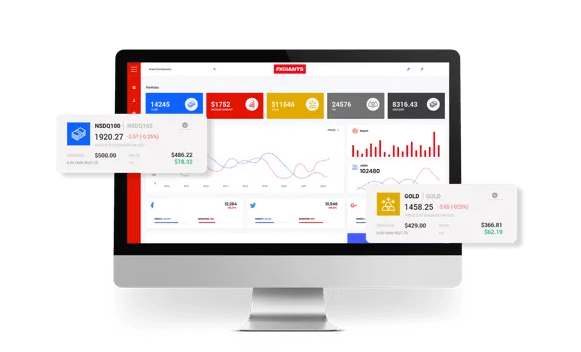

If you’re looking for ways to invest your money, you should definitely consider Cfd trading. Cfd trading stands for contracts for difference, a financial tool that enables traders to invest in markets without having to actually own the underlying asset. This type of trading is incredibly popular because of its high leverage and potential for profit.

However, as with any type of investing, there are risks involved. This blog post will explore the world of Cfd trading, including what it is, how it works, and the potential profit you could make – as well as the risks you should be aware of.

To put it simply, Cfd trading is a type of derivative trading that involves buying and selling contracts based on the price of an underlying asset, such as a market index, currency, or commodity. When you open a CFD trade, you’re essentially betting on whether the price of that asset will go up or down. If you predict correctly, you’ll make a profit; if not, you’ll lose money.

One of the main benefits of cfd trading is that it offers high leverage. This means that you can invest a small amount of money, but potentially make a large profit. For example, if you invest $1,000 in a CFD trade that has a leverage ratio of 1:30, you can control $30,000 worth of the underlying asset. This can be incredibly attractive to traders, as it allows them to take on bigger positions than they would be able to with traditional investing.

Another benefit of Cfd trading is that it enables you to go long or short. This means that you can make a profit when the price of an asset is going up (by going long), or when it’s going down (by going short). This provides traders with a lot of flexibility and the ability to profit in any market condition.

However, it’s important to note that Cfd trading also carries significant risks. Because of the high leverage involved, you can lose a lot of money if you don’t manage your trades carefully. Additionally, Cfd trading involves paying fees, such as the spread (the difference between the buy and sell price of the contract). These fees can eat into your profits and make it harder to make money over the long term.

So, what kind of profit potential does Cfd trading offer? The answer is, it depends. The amount of profit you can make depends on a number of factors, including the size of your investment, the leverage ratio you choose, and the volatility of the market you’re trading in. Some traders make a lot of money through Cfd trading, while others lose money. As with any type of investing, there’s no guarantee that you’ll make a profit – and there’s always a risk of losing money.

short:

Cfd trading can be an exciting and potentially profitable way to invest your money. However, it’s important to be aware of the risks involved and to approach this type of trading with caution. It’s also important to have a solid understanding of the markets you’re trading in, and to use risk management strategies to minimize your losses.

Ultimately, the profit potential of Cfd trading depends on a number of factors, and there’s no guarantee that you’ll make money. However, if you’re willing to put in the time and effort to learn about Cfd trading and to manage your trades carefully, it can be a rewarding way to invest your money and potentially earn a significant profit.